Anyone who’s achieved the elusive dream of home ownership will tell you that saving for the deposit is like chasing a rainbow. Every time you get to where you are aiming for, the endpoint moves again. But there is a possible solution in the Australian Government’s First Home Guarantee.

On the home straight

We spoke with Ruby (27) and Lachie (31) about getting into their first home sooner with the help of Credit Union SA.

How long had you been searching for a property?

We’d been looking for around eight months before we fell in love with a modern three-bedroom townhouse that was just 10 minutes outside Adelaide’s CBD.

What steps did you take once you’d found your dream home?

Looking to start your home ownership journey? Visit the Credit Union SA website.

Well, this is where it got a bit tricky. We loved the townhouse, but we weren’t sure if we had enough savings to cover the 10 to 20 per cent deposit (required by most lenders), stamp duty and other fees.

Our families weren’t able to help us with our deposit or act as guarantors. So, we had to immediately start looking at different options because we really wanted to get this house.

How did you hear about the Australian Government’s First Home Guarantee?

After calling a few lenders, we spoke to Credit Union SA, and they mentioned that we might be eligible for the First Home Guarantee (FHBG).

They explained that if we met the criteria, we could buy the townhouse with a five per cent deposit (plus purchase costs) without having to pay Lenders Mortgage Insurance.

We were so excited, but we had to wait and see whether we’d be accepted.

Lachie and Ruby.

Was it an easy process to go through? How did it work?

It was an incredibly easy process because the First Home Guarantee (FHBG) eligibility criteria is very straight forward. We only had to fill out a form and organise a statutory declaration, Credit Union SA handled the rest.

Once Credit Union SA had done everything they needed to do, they called us back and told us our home loan would be covered by the FHBG.

One of their Lending Specialists, Michelle Aalbersberg, guided us through our home loan application and paperwork.

A valuation of the property was completed, and 10 days later we received unconditional approval for our home loan. This meant we could finally put in an offer. We were pleasantly surprised, shocked and really excited by how easy it was!

Was the amount you offered on the property more than what you originally wanted to pay?

We actually offered less than the asking price thanks to Michelle. She took us through the sales history of the area and helped us settle on a price that was fair but still competitive. She was amazing and really went above and beyond. Find out more about the First Home Guarantee at the Credit Union SA website.

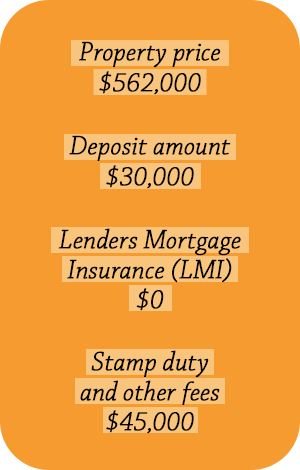

Originally, we were going to offer $575,000 but after we looked over the Core Logic report with Michelle, we went with $565,000. Ultimately, we ended up paying $562,000 because the building inspector found a few issues and we asked the sellers to drop the price based on those findings.

How long did it take from applying for the loan to putting in an offer and getting your keys?

We applied for our home loan on 2 July 2022, put an offer in on 20 August 2022 and received the keys to our new home on 21 October 2022.

We specifically chose to have a later settlement to align with the end of our rental lease.

What were the benefits of the FHBG?

The FHBG helped us buy our first home sooner with just a five per cent deposit and we didn’t have to pay a Lenders Mortgage Insurance premium which saved us around $18,000 altogether.

What advice would you give to other First Home Buyers wanting to use the FHBG?

Just apply. You really have nothing to lose by checking your eligibility. There are no hoops to jump through to prove anything. It’s just, ‘yes, you meet the criteria’, or ‘no you don’t’. It saved us so much time and money!

What are your plans for this house? Will you hold onto it and sell in a few years, or will this become your forever home?

We haven’t got any plans to sell. It has everything we need in a great location. We’re close to our friends, work, and our favourite city spots. We love it here.

The guarantee lowdown

What is the First Home Guarantee (FHBG) and how does it work?

The purpose of the First Home Guarantee (FHBG) is to support eligible home buyers to enter the housing market sooner.

If you’re eligible, you can purchase or build a modest home with a deposit of as little as five per cent without paying Lenders Mortgage Insurance (LMI), which could potentially save you thousands. This is because Housing Australia, which administers the Scheme, guarantees to us, as a participating lender, up to 15 per cent of the value of the property.

There are 35,000 FHBG places available from 1 July 2023 for the 2023-24 financial year, through a panel of participating lenders, including Credit Union SA.

The First Home Guarantee is part of the Home Guarantee Scheme which also includes the Family Home Guarantee (FHG) and Regional First Home Buyer Guarantee (RFHBG).

Am I eligible?

You need to…

- be an Australian citizen or permanent resident and at least 18 years old.

- be a first home buyer or a buyer who hasn’t owned a property in Australia in the past 10 years.

- be buying a property that you will live in.

- be able to demonstrate your ability to save over time (genuine savings), with a minimum five per cent deposit saved for the property you wish to buy plus enough to cover standard fees and charges like stamp duty. Check out the cost calculator here.

- meet the income eligibility requirements, which are single buyers earning up to $125,000, or joint applicants (which can be married or de-facto couples, friends, siblings or other family members) earning up to $200,000 per annum for the previous financial year, as shown on the Notice of Assessment (issued by the Australian Taxation Office). Find out more here.

There are property price thresholds that apply. Use the Housing Australia postcode search tool to find out the maximum property price of the area you’re interested in.

What type of property can I buy?

For a property to be eligible it must be…

- an existing house, townhouse or apartment.

- a house and land package.

- land and a separate contract to build a home.

- an off-the-plan apartment or townhouse.