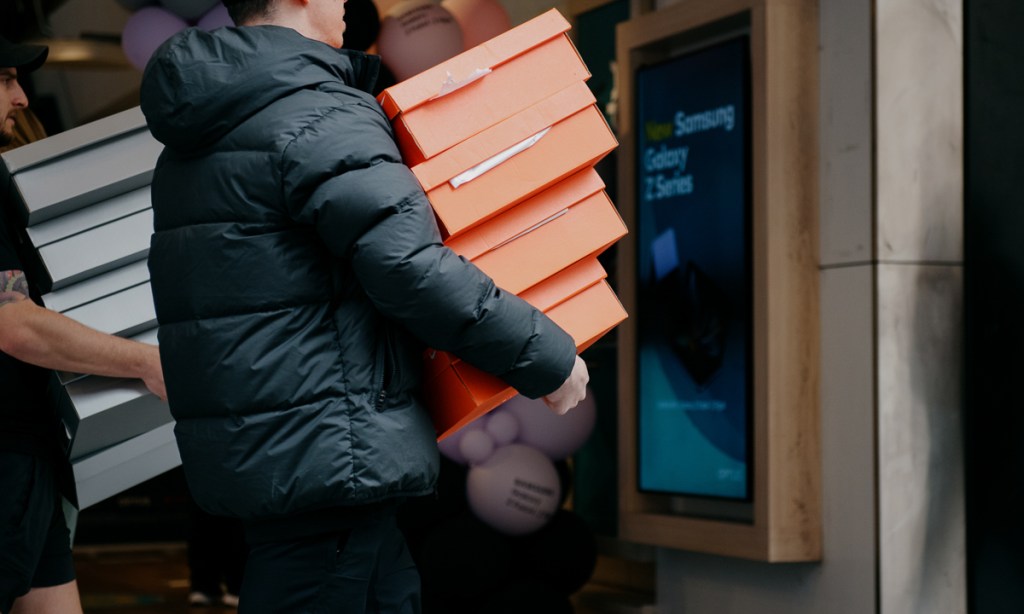

A growing fashion industry requires consumers acting on desire rather than making rational purchasing decisions. A new type of payment service has emerged to allow shoppers to make larger purchases on credit, but it’s leaving some in debt.

Buy now, pay (and pay and pay) later

When browsing your favourite online retailer, you’ve likely landed on a product page and seen one, or perhaps many, increasingly familiar logos below the item’s price.

If you’re having difficulty repaying a BNPL debt or struggling financially, free support is available by calling the National Debt Helpline on 1800 007 007

As you move your cursor towards the ‘buy now’ button, you’ll also see a slightly smaller price next to the logos – Afterpay (the Bondi mint logo), ZipPay (a bold purple) or Klarna (a slightly curvy sans-serif font).

These are buy now pay later (BNPL) services, and they allow shoppers to pay for their desired items in a series of instalments rather than in a lump sum. The new payment method has cemented itself into both digital and real-world checkouts, and in doing so has shaken up the shopping experience.

Lauren Crago, founder of ecowear label Solomon Street, says BNPL has become a large part of the fashion ecommerce space. Still, she feels conflicted about offering it.

“It is expected of a lot of fashion brands… and for a lot of customers, their default method is using buy now pay later. They won’t purchase without it,” Lauren says.

Lauren Crago. This picture: Sharmonie Cockayne

Solomon Street offers Afterpay, one of the largest BNPL providers, at checkout, but the logo doesn’t appear on its product pages. Lauren is wary of using Afterpay as a selling point for her brand. She’s aware it’s a potentially problematic service, enabling overspending, particularly in the fashion and retail space.

Unlike the more highly regulated credit industry, BNPL allows you to fill your wardrobe with few financial checks and little oversight.

And while many BNPL products are marketed as interest-free, missed repayments are subject to late fees, which can be difficult for buyers to recover from. This raises red flags with financial counsellors, as BNPL users are falling into a cycle of dependency.

Research from Curtin University, commissioned by Financial Counselling Australia, debunked the idea that BNPL is a free or low-cost option compared to a traditional credit card.

The study compared account-keeping and late fees of BNPL providers against annual interest rates of a typical credit card. Using Afterpay as an example, they found if a customer incurred late fees on an average purchase of $151, the effective equivalent interest rate was 28.25 per cent.

Kate Fox, the executive officer at the South Australian Financial Counsellors Association, says while she’s pleased federal treasury committed to consultation on regulating BNPL services, she remains concerned.

“Buying those things you don’t necessarily need can put you in financial difficulty because when you try to pay that back, you can’t afford the things you do need, and it’s a cycle of people falling into a debt trap,” Kate says.

Lauren shares this concern, noting fashion and retail are industries that rely on shoppers’ desires more so than their needs.

“These providers tend to leverage fashion because they are businesses led by desire,” the founder says.

“When you’re shopping for, say, a gardening tool, that’s not a sexy item. You can save and wait for it. But the fashion industry is led by people’s desire… They really love to elevate their image and idea of themselves.”

With strong values of sustainability at its heart, Solomon Street clothing is cut and sewn ethically, using digitally printed fabric and avoiding chemical dyes, and its price point is reflective of this ethos. Afterpay, to its credit, makes Solomon Street clothing more accessible.

Lauren does still feel the need to promote responsible spending in her business’s brand messaging, though.

“Friends of mine have a very intimate relationship with their clothes, and look at the purchase as an investment because a piece of clothing will come into their life for a long-term relationship,” Lauren says.

She hopes this emphasis on fashion as a long-term investment counters the risks that can come with BNPL. “Fast fashion brands use buy now pay later as a big marketing tool to sell a bulk amount of items as quickly and as frequently as possible, and I find that problematic,” Lauren says.

“[Solomon Street customers] might use buy now pay later services to be able to bring a piece of clothing into their life sooner and monitor their payments, but it is still a very considered choice.”

Solomon Street tops

Until regulation comes, the responsible use of BNPL products relies on self-discipline and financial literacy of the customer.

It is not the intention of local brands to encourage poor spending habits through the use of BNPL, but the services do help them keep up with the evolving and competitive ecommerce landscape.

Stephanie Dimasi, co-owner of Room on Fire Vintage, says BNPL is integrated with the future of online shopping. They choose to offer Afterpay because they see the trust Australians have in the provider. Approximately 30 per cent of their online sales have used Afterpay so far this year.

“It would be detrimental in the current ecommerce climate to not have a buy now pay later option,” Stephanie says.

“For me, it would only be Afterpay I would be interested in, because I think people have the most loyalty to it.”

Room on Fire offers Afterpay online and instore. They find most of the orders using Afterpay are for multiple items purchased at once. They don’t currently have any restricting policies on Afterpay users, such as a minimum spend or limited returns.

“I have complete trust in our customers, and I don’t want our individual policies to affect the customer journey,” Stephanie explains.

“I’ve also noticed some business won’t process returns for purchases done with Afterpay, but I see it as a standard payment method that’s become part of the DNA of ecommerce payment methods. We treat it like we would if someone was shopping on PayPal or their credit card.”

Room on Fire co-owners Reuben lane and Stephanie Dimasi

Room on Fire’s online store came before their physical presence in Hindmarsh Square. Local fashion label Sally Phillips had the opposite journey, with an online store offering a BNPL service being the extension of an appointment-only shopping experience.

Sally Phillips’ collections are made to order, and studio manager Isobel Milne says most clients are used to the structure of making an initial deposit and then making further repayments.

“Our new collection launches in August. Clients will have appointments in the first two weeks of September and pay a 30% deposit when pre-ordering from that collection… so to offer Afterpay to our clients online was a no-brainer because we’ve always used that format,” she says.